RISING PRICES ADD ALMOST 20% TO “MINIMUM” COST OF RETIREMENT

Thursday 12th January 2023Retirees trying to achieve a basic standard of living will have seen their expenditure increase over the last year by almost 20% due to high inflation, highlighting the need for pension reform to help more people achieve an adequate income in retirement.

In the latest inflation update of the Pensions and Lifetime Savings Association’s Retirement Living Standards, people on the Minimum lifestyle have seen the biggest percentage increase to the cost of their retirement, owing to the higher proportion of their budget going towards the things that have risen the most in price: food and energy.

Based on independent research by the Centre for Research in Social Policy at Loughborough University, the Retirement Living Standards describe the cost of three different baskets of goods and services, established by what the public considers realistic and relevant expectations for retirement living. These baskets comprise six categories: household bills, food and drink, transport, holidays and leisure, clothing and social and cultural participation.

Changes to the Retirement Living Standards over the past year and required pot sizes

The Retirement Living Standards are regularly reviewed to ensure they keep up with changes in the public’s expectations of what retired households need as well as the changes to prices on the shelves to remain relevant to real world retirement spending.

The cost of a Minimum lifestyle increased from £10,900 to £12,800 – or 18% – for a single person and from £16,700 to £19,900 – or 19% – for a couple. The Minimum Retirement Living Standard is the same as the Joseph Rowntree Foundation’s Minimum Income Standard (MIS) and reflects what members of the public think is required to cover a retiree’s needs, not just to survive but to live with dignity – including social and cultural participation. It includes £96 for a couple’s weekly food shop, a week’s holiday in the UK, eating out about once a month and some affordable leisure activities about twice a week. It does not include budget to run a car.

Rising food and fuel prices contributed significantly to the increase in the Minimum standard. The update also saw the amount of food included within the budget increasing to bring it into line with the up-to-date nutritional research on a healthy diet.

The disproportionate increase in the cost of retirement for those on the Minimum Retirement Living Standard means the government’s commitment to the state pension triple lock, announced in the most recent Autumn Statement, is especially important. Rising by a record 10.1% to £10,600 per year, a couple who are each in receipt of a full new state pension would reach the Minimum Retirement Living Standard.

This level should also be very achievable for a single person if they supplement the state pension with income from a workplace pension saved through automatic enrolment during their working life.

The Moderate level increased 12% to £23,300 for a single retiree and by 11% to £34,000 for a couple. The Moderate Retirement Living Standard, in addition to the minimum lifestyle, provides more financial security and more flexibility. For example, a couple could spend £127 on the weekly food shop, have a two-week holiday in Europe and eat out a few times a month.

To achieve this level, a couple sharing costs with each in receipt of the full new state pension would need to accumulate a retirement pot of £121,000 each, based on an annuity rate of £6,200 per £100,000.

At the Comfortable Retirement Living Standard, retirees can expect to have more luxuries like regular beauty treatments, theatre trips and three weeks holiday in Europe a year. A couple could spend £238 per week on food shopping. At this level, the cost of living increased 11% to £37,300 for one person and 10% to £54,500 for a two-person household.

To achieve this level, a couple sharing costs with each in receipt of the full new state pension would need to accumulate a retirement pot of £328,000 each, based on an annuity rate of £6,200 per £100,000.

A ‘minimum’ lifestyle covers all your needs, with some left over for fun and social occasions. You could holiday in the UK, eat out about once a month and do some affordable leisure activities about twice a week.

About three quarters of employees are likely to achieve at least the minimum standard.

A ‘moderate’ lifestyle provides more financial security and more flexibility. You could have one foreign holiday a year and eat out a few times a month. You’d have the opportunity to do more of the things you want to do.

Around half of employees are projected to have an income between minimum and moderate.

A lifestyle that allows you to be more spontaneous with your money. You could have a subscription to a streaming service, regular beauty treatments and two foreign holidays a year.

About one in six employees are projected to have an income between moderate and comfortable.

Minimum:

£14,400

Covers all your needs, with some left over for fun

Minimum:

DIY maintenance and decorating one room a year.

Minimum:

£54 a week on food (including food away from the home).

Minimum:

No car.

Minimum:

A week and a long weekend in the UK every year.

Minimum:

Up to £580 for clothing and footwear each year.

Minimum:

£20 for each birthday present.

Moderate:

£31,300

More financial security and flexibility

Moderate:

Some help with maintenance and decorating each year.

Moderate:

£74 a week on food (including food away from the home).

Moderate:

3-year old car replaced every 10 years.

Moderate:

2 weeks in Europe and a long weekend in the UK every year.

Moderate:

Up to £791 for clothing and footwear each year.

Moderate:

£34 for each birthday present.

Comfortable:

£43,100

More financial freedom and some luxuries

Comfortable:

Replace kitchen and bathroom every 10/15 years.

Comfortable:

£144 a week on food (including food away from the home).

Comfortable:

2-year old car replaced every five years.

Comfortable:

3 weeks in Europe every year.

Comfortable:

Up to £1,500 for clothing and footwear each year.

Comfortable:

£56 for each birthday present.

*These amounts would fund this lifestyle for people living outside

London. See

The Detail

for more information.

Single

{

"single": "House",

"cohabiting": "House"

} {

"single": "Food",

"cohabiting": "Food"

} {

"single": "Transport",

"cohabiting": "Transport"

} {

"single": "Holidays & Leisure",

"cohabiting": "Holidays & Leisure"

} {

"single": "Clothing & Personal",

"cohabiting": "Clothing & Personal"

} {

"single": "Helping Others",

"cohabiting": "Helping Others"

}

Automatic enrolment reform needed

Nigel Peaple, Director Policy & Advocacy, PLSA, said: “The past year has been an enormously challenging one for many households in the UK. Inflation has risen to its highest rate in 40 years with the cost of essentials and domestic fuel soaring, putting substantial pressure on incomes for working age and retired households, particularly for those on low incomes. These figures underline why the Government was right to increase the State Pension in line with the Triple Lock in the Autumn Statement.

“The jump in the Retirement Living Standards underscores the need for the Government to adopt the PLSA’s recommendations on pensions set down in our recent report, “Five Steps to Better Pensions”. These include the need for the Government to adopt clear national objectives for retirement income, to ensure the state pension protects everyone from poverty and, later this decade once the cost-of-living crisis has passed, to increase the scope and level of automatic enrolment pension contributions.”

Rising prices affect some goods and services more than others.

The annual increase in what is needed to reach each living standard level over the last year is by far the largest since the Retirement Living Standards (RLS) were first established in 2019. Across all of the RLS, the increase in the price of domestic fuel has been the most significant factor in increasing what is needed overall. Between 2021 and 2022, the weekly cost of domestic fuel rose by around 130%. The increase in the weekly cost of domestic fuel accounts for between 30-40% of the increases in the overall budgets for a minimum, moderate and comfortable living standard in retirement between 2021 and 2022.

Increases in the costs associated with motoring at the moderate and comfortable RLS over the past year – driven by increases in the cost of second-hand cars and in the cost of petrol/diesel – have resulted in this element of the budgets increasing by 16%.

At all levels, higher interest rates will help to alleviate the cost pressure of higher prices as savers are able to get more attractive rates on annuities for their retirement pots than in recent years.

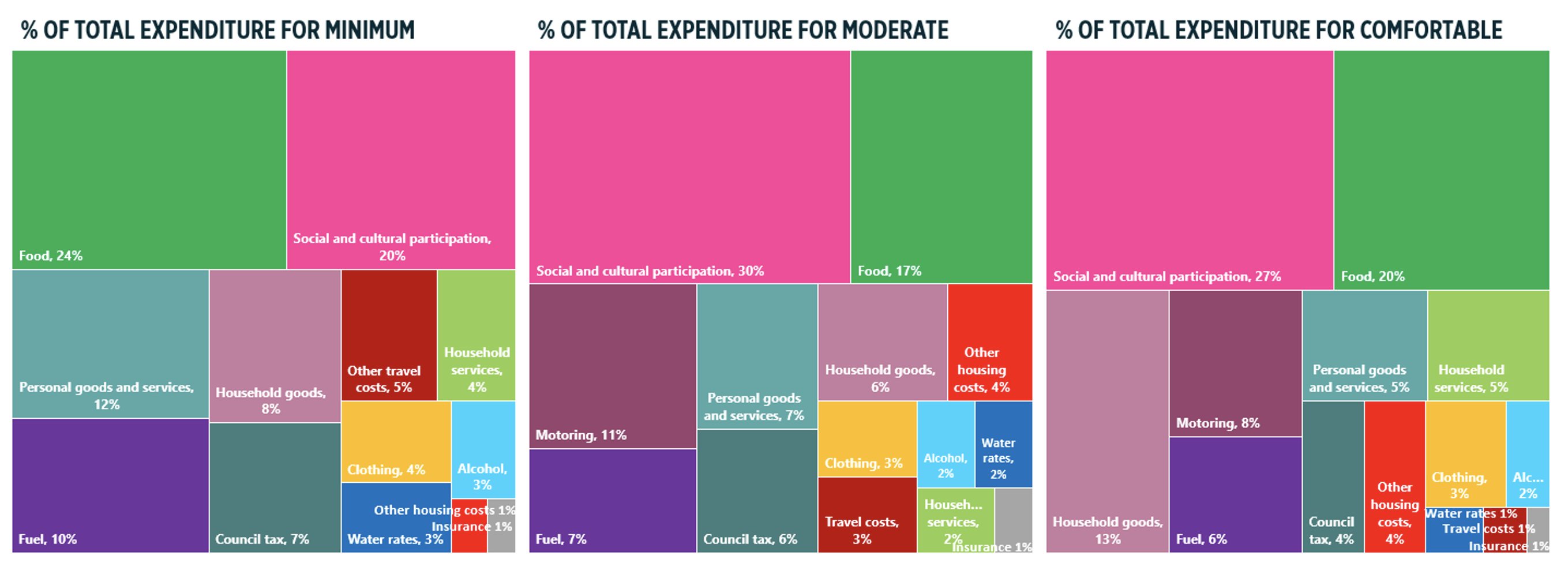

- Expenditure on food and fuel are categories that have seen significant price rises over the year and account for around a third of the budget at a minimum, compared to around a quarter at the moderate and comfortable levels.

- The absence of being able to socialise during COVID lockdowns has reinforced for many the need to be able to devote some budget to social activities as a way of participating in society. All budgets include some expenditure on social and cultural participation, accounting for a fifth of the minimum income standard budget but a larger proportion of the moderate and comfortable levels.

- The minimum standard relies on the use of public transport, but at the moderate and comfortable levels car ownership takes up around 10% of the expenditure. Motoring costs have risen significantly driven by increases in the cost of purchasing second-hand cars and by the increases in the cost of petrol/diesel.

ENDS

NOTES TO EDITORS

The Retirement Living Standards are being used across the pensions and savings industry in the UK, helping savers to understand what they’ll need in retirement and how this compares to projected pensions income. Through the communications of more than 100 pension schemes and organisations, including some of the largest and best-known brands, the Standards are reaching up to 35 million savers.

Importantly, they do not include the cost of housing (mortgage payments or rental costs) because the majority of people are projected to own their own home by the time they reach retirement and many others receive welfare payments to meet rental costs. In addition, due to significant variations in housing costs across the UK, including the vastly different costs of small as compared with large properties, it is not possible to identify a single cost that can be used in the RLS. Instead, for those who still have mortgage or rental costs in retirement, it is more accurate to add this on an individual basis.

The RLS figures quoted here are for the UK, excluding London. Costs within the capital are higher. A further update of the MIS London figures based on research just concluded will be published by the Centre for Research in Social Policy at Loughborough University early in 2023.

Visit the dedicated Retirement Living Standards website to read the Centre for Research in Social Policy at Loughborough University’s full report on the 2022 update including the methodology for applying inflation increases.

The pot size calculation assumed an annuity of £6,200 per £100,000 and is illustrative. Annuity rates change frequently and vary according to product type, saver age and other circumstances (e.g. location, health etc.).

PRESS CONTACTS

Mark Smith, Head of Media Relations

T: 020 7601 1726

E: mark.smith@plsa.co.uk

Steven Kennedy, Senior PR Manager

T: 020 7601 1737

M: 07776 859241

E: steven.kennedy@plsa.co.uk

ABOUT THE PENSIONS AND LIFETIME SAVINGS ASSOCIATION

The Pensions and Lifetime Savings Association is the voice of workplace pensions and savings. We represent pension schemes that together provide a retirement income to more than 30 million savers in the UK and invest more than £1.3 trillion in the UK and abroad. Our members also include asset managers, consultants, law firms, fintechs, and others who play an influential role in people’s financial futures. We aim to help everyone achieve a better income in retirement.